Photo by Priscilla Du Preez on Unsplash

Gig Workers Need Their Own Money Playbook

Gig work isn’t just a job. It’s a lifestyle. It’s about freedom. But real freedom takes financial security, and gig life doesn’t make that easy.

No steady income, no employer benefits, no safety net and no pension can make gig life a financial minefield. Unfortunately, most personal finance sites are too “old school” to help you avoid landmines that can blow up your finances.

The Wealthy Gigster is built just for gig workers. We are not your grandma’s personal finance site. Here, we give real, gig-world advice, so you can build your wealth and life on your own terms—even when your income doesn’t play nice.

Start Your Wealthy Gigster Journey Here

You don’t need steady gig income to build wealth—you just need the right strategy. We call it gig money management for gig workers.

Let’s Get You Ready to Live the Gig Life

Gig work gives you freedom—until that freedom includes figuring out taxes, saving for slow months and retiring without a pension. Let’s get you ready to live that kind of life.

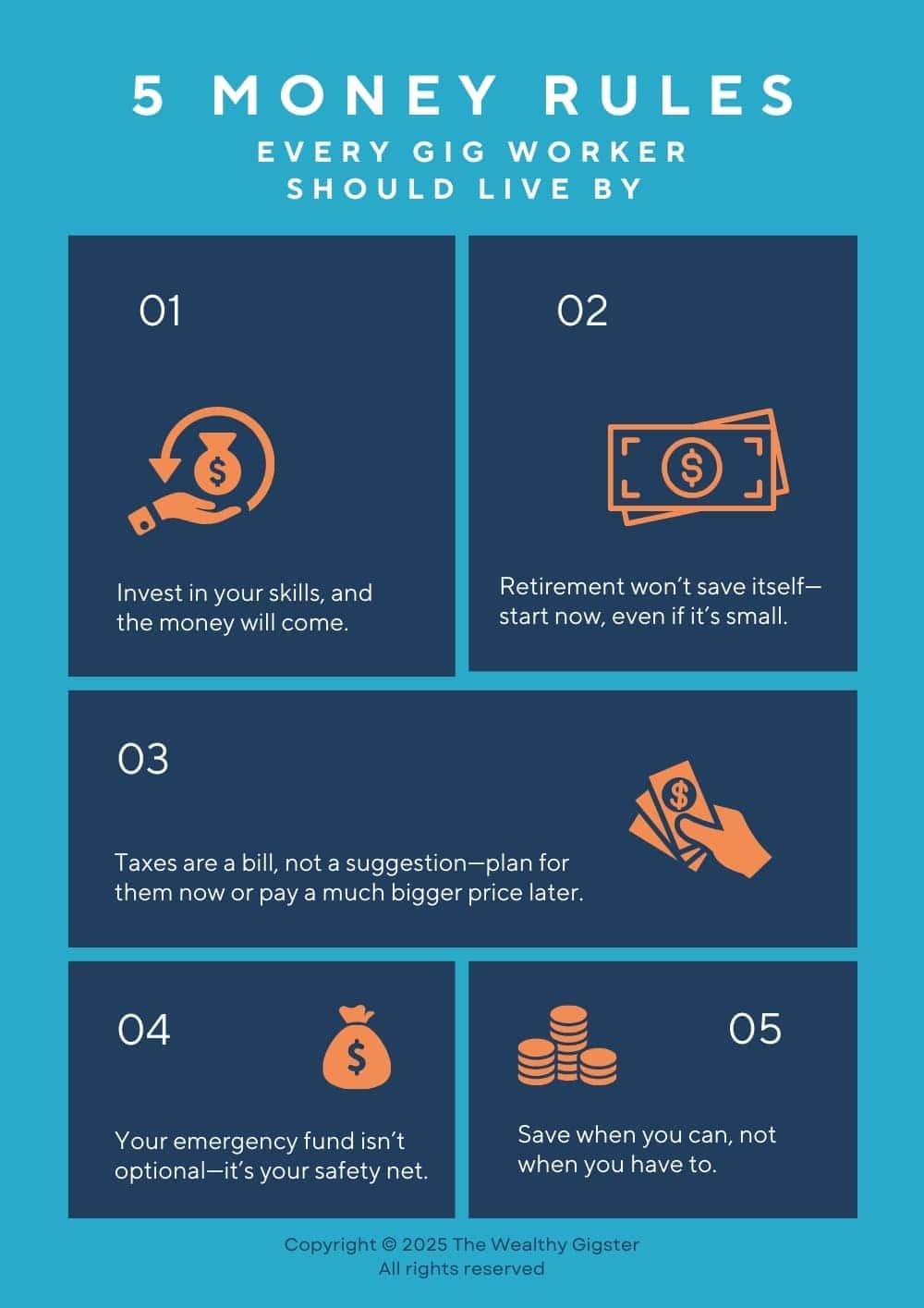

- Save when you can, not when you have to.

One slow month or bad client can throw everything off. Save when times are good, so you’re covered when they’re not. - Taxes are a bill—plan for them now or pay a much bigger price later.

Set aside 20%-30% of every payment, so tax season doesn’t blindside you when the payment’s due. - Your emergency fund isn’t optional—it’s your safety net.

No sick leave, no paid time off. Build a three-month cushion, so slow months don’t turn into financial disasters. - Invest in yourself—your skills are your best assets.

The more valuable your skills, the more you can charge. Upskilling isn’t an expense—it’s your best investment. - Retirement won’t save itself—start now, even if it’s small.

No pension? No problem—if you plan ahead. Even $25 a month invested early makes a difference later.

Get free exclusive money advice.

Because you earned it.

Sign up for our newsletter and get the free exclusive money advice you need to live a richer gig life.

By subscribing to our newsletter, you acknowledge and agree to our Terms of Use and Privacy Policy. You can unsubscribe at any time.

Gig Money Management for Gig Workers

Here, find all the gigster-friendly advice, tools, resources and support you need to cut back on the financial stress that comes with gig life, live well today and build real wealth for tomorrow.

Earn Gig Money Faster

Working more isn’t the answer—working smarter is. Learn how to make more gig money without burning out.

Save Money and Live Better

You can’t predict your income, but you can prepare for the dry spells. Saving is survival. Let’s make it easier for you.

Budget Your Gig Money

Your income changes, so your budget should too. Traditional budgeting advice? It’s not built for you. Here’s what actually works.

Invest Your Gig Money

No pension? No problem—if you start investing now. Here’s how to make your money work, while you work.

Manage Your Debt

Debt is easy to get into, harder to get out of. Let’s make sure you stay in control—even when cash flow gets messy.

Get Credit Savvy

Gig workers CAN get credit—but lenders don’t make it easy. Here’s how to get credit without digging yourself into a hole.

Protect Your Gig Money

No employer benefits? No safety net? It’s up to you to protect your money, so let’s make it happen.

Handle Your Taxes

Taxes as a gig worker? A nightmare—unless you have a system. Here’s how to keep more of what you earn.